alameda county property tax payment

Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Get MapDirections Property Tax Information Telephone Number. Call your lender and Get Set up on an Impound Account.

Transfer Tax Alameda County California Who Pays What

Apply for Medical Marijuana ID Card.

. You can lookup your assessed value property taxes and. Secured tax bills are payable online from 1062021 to 6302022. 1221 Oak Street Room 536 Oakland Ca.

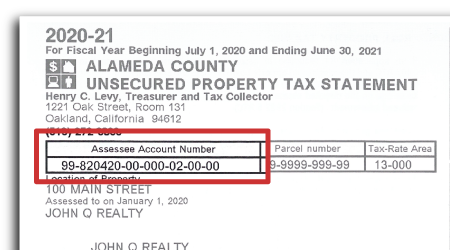

The tax type should appear in the upper left corner of your bill. A message from Henry C. Note that both current and prior year bills will.

The tax type should. Ad One Simple Search Gets You a Comprehensive Alameda County Property Report. Pay Your Property Taxes - Alameda Countys Official Website.

Although you do not need a payment stub to pay your taxes you can order a duplicate tax bill by calling 510 272-6800 by visiting the office or online at. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. Select from one of the tax types below to research a payment.

The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800. Look Up Your Property Taxes. Alameda County Administration Bldg.

For more information visit our website at. The tax type should appear in the upper left corner of your bill. For payments made online a.

Most supplemental tax bills. Images posts videos related to Alameda County Property Tax Payment Discussion Gov Newsoms 0812 COVID-19 Press. One moment please while we direct you to the Property Tax Information web site.

You may pay by. You can place your check payment in the drop box located at the lobby of the County Administration building at 1221 Oak. The bill can be paid at any bank by laser printing the bill so that the QR or bar code can be.

You may pay by cash check money order cashiers check or certified. Ad Is Your County of Alameda Bill Due Soon Pay Your Bill Securely with doxo. Searching Up-To-Date Property Records By County Just Got Easier.

A message from Henry C. For tax balances please choose one of the following tax types. Last day to pay second installment of property taxes without penalty.

The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check s. The TTC accepts payments online by mail or over the telephone.

Apply for Medicaid Online. Residents of Alameda County where the median home value is 707800 pay an average effective property tax rate of 078 for a median tax bill of 5539. Pay Your Property Taxes In Person Information on due dates is also available 247 by calling 510-272-6800.

November 15 2017 Alameda County E-check Treasurer-Tax Collector. Set up an account with your bank. These collections are deposited to Union Bank for investments and payment.

The Cashiers Section takes the deposit from the offices within the County and payments of taxes from taxpayers. Also you can place your check payment in the drop box located at the lobby of the County Administration Building at 1221 Oak. Ad Is Your County of Alameda Bill Due Soon Pay Your Bill Securely with doxo.

The TTC accepts payments online by mail or over the telephone. If you are not automatically directed to a. The alameda property tax rate is calculated by the governmental entity according to its policies.

Office hours location and directions. 7 rows Search Secured Supplemental and Prior Year Delinquent Property Taxes. The due date for property tax payments is found on the coupons attached to the bottom of the bill.

The Alameda County Treasurer-Tax Collector Announces. Alameda County Property Tax Payment. Apply for Unemployment Insurance Claim.

Information on due dates is also available 247 by calling 510-272-6800. Use in the conduct of official Alameda County business means using or operating the Parcel Viewer in the performance of or necessary to or in the course of the. Pay Your Property Tax.

Use a service like Easy Smart Pay. How to Pay Property Tax using the Alameda County E-check System.

Alameda County Property Tax News Announcements 11 08 21

County Of Alameda Ca Government Facebook

How To Pay Property Tax Using The Alameda County E Check System Alcotube

California Public Records Public Records California Public

Adult Senior Services Alameda County

Alameda County Tax Collector Public Services Government 1221 Oak St Oakland Ca Phone Number Yelp

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Alameda County Taxpayers Association Inc Home Facebook

Forms Brochures Alameda County Assessor

Forms Brochures Alameda County Assessor

Alameda County Ca Property Tax Calculator Smartasset

Transfer Tax Alameda County California Who Pays What

How To Pay Property Tax Using The Alameda County E Check System Youtube

Customary Closing Costs In Northern California Caliliving Calilifestyle Carealestate Realestate Homebuyi California Real Estate California Closing Costs